Social Security Income Cap 2024

Social Security Income Cap 2024. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. The amount you pay is determined by a.

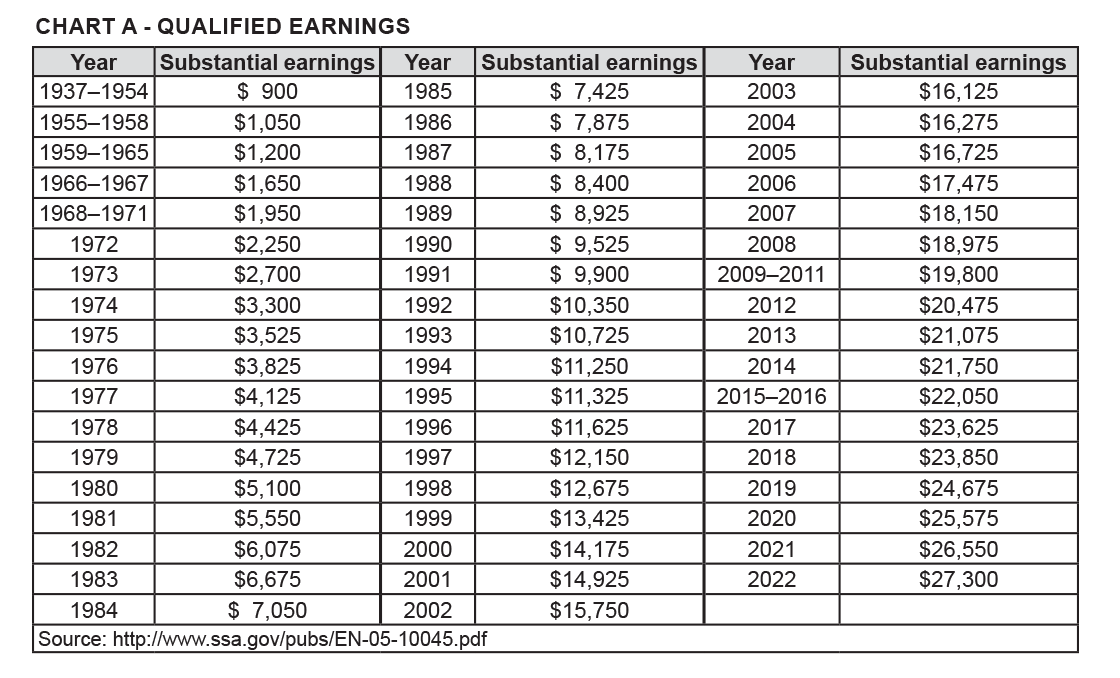

The maximum earnings that are taxed have changed through the years as shown in the chart below. In 2024, the social security wage base limit rises to $168,600.

The Same Annual Limit Also Applies When Those Earnings Are Used In A Benefit Computation.

For 2024, the social security tax limit is $168,600.

Social Security Tax Limit For 2024.

The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an income tax on that money.

The Special Rule Lets Us Pay A Full Social Security Check For Any Whole Month We Consider You Retired, Regardless Of Your Yearly Earnings.

Images References :

Source: alviniawjade.pages.dev

Source: alviniawjade.pages.dev

Social Security 2024 Limits Aili Lorine, If you will reach fra in 2024, the earnings limit goes up to $59,520 and $1 is deducted from your benefits for every $3 you earn over that. The typical senior gets less than $2,000 per month.

Source: laviniewviole.pages.dev

Source: laviniewviole.pages.dev

How Much Will Ssi Recipients Receive In 2024 Rikki Christan, Above that amount, social security will deduct $1 for every $3 in income. That’s what you will pay if you earn $168,600 or more.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Above that amount, social security will deduct $1 for every $3 in income. The prime minister emphasized commitment to buddha's ideals for a prosperous planet.

Source: allyqlilllie.pages.dev

Source: allyqlilllie.pages.dev

Social Security Earnings Limit In 2024 Beckie Rachael, Social security and supplemental security income (ssi) benefits for more than 71 million americans will increase 3.2 percent in 2024. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings.

Source: 2022drt.blogspot.com

Source: 2022drt.blogspot.com

Social Security Maximum Taxable Earnings 2022 2022 DRT, Social security tax limit for 2024. The maximum earnings that are taxed have changed through the years as shown in the chart below.

Source: hollieqadriana.pages.dev

Source: hollieqadriana.pages.dev

Social Security Limit On Earnings 2024 Wynny Karolina, So, if you earned more than $160,200 this last year, you won't have to pay the social. Candidates who have completed class 12 and meet the eligibility criteria can submit their mu ug admission application form for 2024 through the official website, mum.digitaluniversity.ac.

Source: tammarawmira.pages.dev

Source: tammarawmira.pages.dev

How Much Ssi Will Get In 2024 Roch Violet, The social security administration also announced the 2024 wage cap. The most you will have to pay in social security taxes for 2024 will be $10,453.

Social Security full retirement age and benefits Nectar Spring, Above that amount, social security will deduct $1 for every $3 in income. For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

Social Security Limit for 2022 Social Security Genius, This amount is known as the “maximum taxable earnings” and changes each year. In 2023, the limit was $160,200.

Source: www.tabitomo.info

Source: www.tabitomo.info

Qualifying For Social Security As A Legal Immigrant Tabitomo, In 2024, if you’re under full retirement age, the annual earnings limit is $22,320. The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an income tax on that money.

Above That Amount, Social Security Will Deduct $1 For Every $3 In Income.

If your retirement plan involves falling back on social security alone, here's some important information.

News January 29, 2024 At 05:23 Pm Share &Amp; Print.

The social security administration deducts $1 from your social security.